While 1.81% may seem insignificant, over the course of 20 years the difference in dollars is nothing short of staggering. The critical takeaway is that while the S&P 500 returned an average of 6.06% per year since 1999 (including two harsh bear markets in 20), the average stock investor only realized about 4.25% per year. details the 20-year history of the typical investor, the most recent spanning December 31st, 1999 to December 31st, 2019. One study done every year by the research firm DALBAR Inc. Unfortunately, numerous industry studies confirm the historic damage suffered by those succumbing to the siren’s song of market timing. Studies Confirm Time in the Market Beats Timing the Market: Are You Prepared to Protect Yourself from a Knee-Jerk Reaction? Too often investors project either irrational fear or over-confidence regarding future returns and in turn, buy or sell before they think “the market” will move higher or lower. Of course, hindsight is 2020 (no pun intended) but the point is that protecting ourselves from ourselves is paramount when it comes to emotion-driven buying and selling. In fact, if one was horribly unfortunate and exited at the bottom of the market on March 23rd, they would have missed a 70%+ return from the bottom in just over nine months. But what was not different was that stock markets tend to overreact in the short term but typically course-correct over the long term in valuing the future value of companies’ cash flows. Those who did were mostly thinking about the four most expensive words in investing: “It’s different this time.” To be fair, 2020 was different in that it’s been over 100 years since we’ve endured a global pandemic. Looking back at the nadir of the S&P 500 on March 23rd, one couldn’t be blamed for considering selling stocks. What’s interesting is that many years from now when memory has faded, return tables of the S&P 500 will simply show an 18% gain - just another “above-average” year for stock investors. The 2020 roller-coaster ride is a case study in both the severity and the speed of 30%+ market moves.

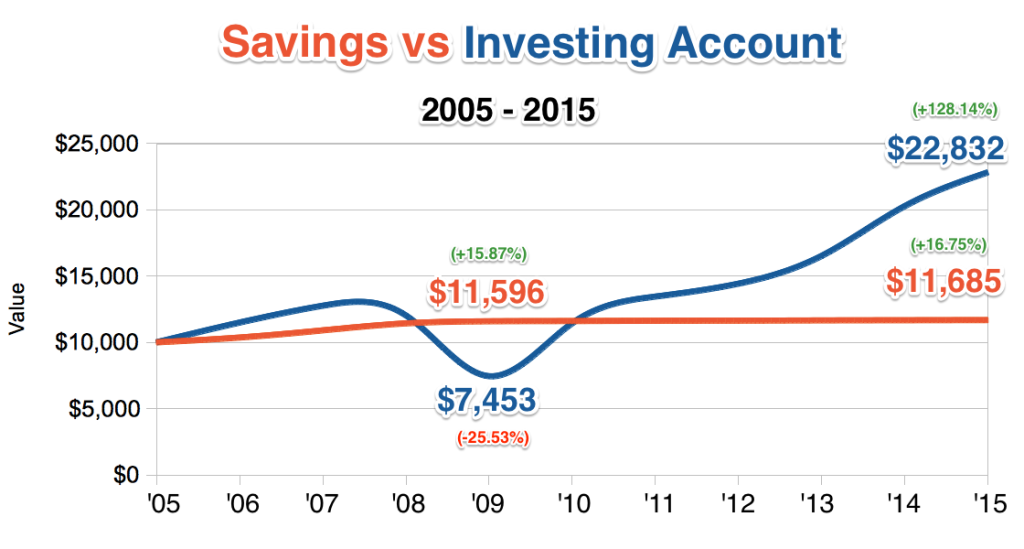

The chart below depicts just how volatile stock markets can be. January’s “short squeeze” of Gamestop and other stocks showed just how far retail investing has come thanks to these technologies. A potent cocktail of gamified trading apps and media-driven hyperbole has drawn many new investors in, which has led to higher volatility in certain areas of the market. Recent headlines have highlighted how an increasing number of investors have treated the stock market more like a short-term gamble than a long-term savings strategy.

The prudent investor, however, can reflect on 2020 as a historic “teachable moment” on how counter-intuitive market performance can be and how attempting to time the market can be confounding, and even dangerous.

Timing the Marketįor more reasons than we care to recount, 2020 will certainly go down as a year to remember and a year to forget. Why We Recommend Focusing on Time in the Market vs.

0 kommentar(er)

0 kommentar(er)